Though it doesn’t produce them directly, Nvidia, the clear leader in AI-driven semiconductors, designs its state-of-the-art chips in the US. Rather, it depends on an intricate worldwide supply chain, with Taiwan Semiconductor Manufacturing Company (TSMC) producing the majority of its chips.

Through this strategic alliance, Nvidia is able to take advantage of TSMC’s top-notch fabrication technology, especially when it comes to producing cutting-edge AI chips like the H100 and the most recent Blackwell series. However, the question of where Nvidia‘s chips are made is more important than ever because supply chain disruptions are becoming a common problem and geopolitical tensions are increasing.

Where Are Nvidia Chips Manufactured? Key Details

| Category | Details |

|---|---|

| Headquarters | Santa Clara, California, USA |

| Primary Manufacturer | Taiwan Semiconductor Manufacturing Company (TSMC) |

| Manufacturing Locations | Taiwan (TSMC), Limited production in Samsung (South Korea) |

| Upcoming Facilities | TSMC’s Arizona plant (expected 2025), Potential Intel partnership |

| Process Nodes Used | 4nm, 5nm, and upcoming 3nm technology |

| Major Products | AI GPUs (H100, Blackwell, RTX series) |

| Geopolitical Risks | Taiwan-China tensions, U.S. trade policies |

Nvidia’s Semiconductor Success Is Driven by TSMC

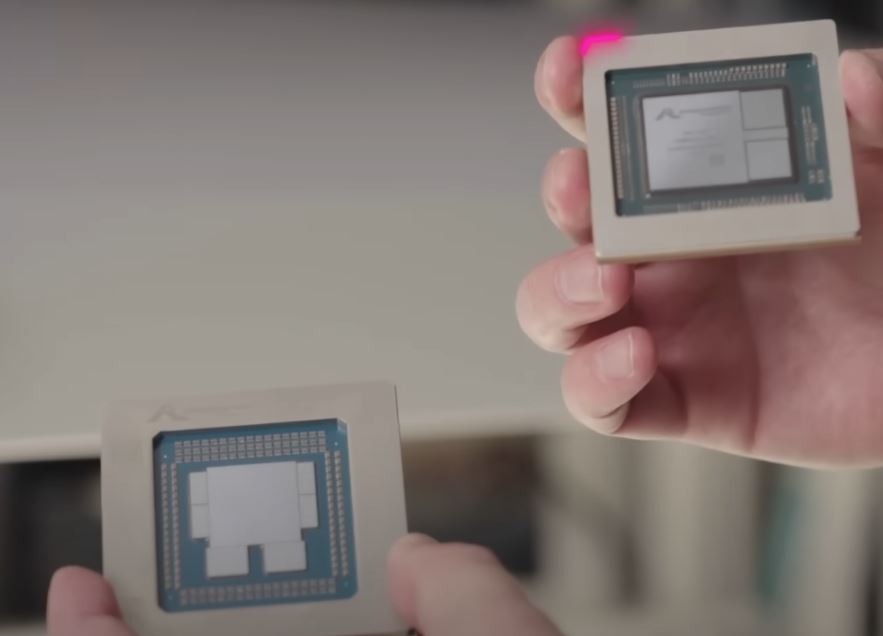

The main producer of Nvidia’s most cutting-edge chips is TSMC, a company based in Taiwan. The foundry’s state-of-the-art 4nm and 5nm process nodes are used to produce high-performance semiconductors. With its chips powering everything from data centers to self-driving cars, Nvidia has established itself as the industry leader in AI and gaming thanks to this capability.

However, there are serious risks associated with depending solely on one Taiwanese supplier, which has sparked debate about expanding the locations of production.

The Drive for American Production of Semiconductors

The U.S. government has been actively encouraging domestic semiconductor production as geopolitical uncertainties hover over Taiwan. The goal of the multibillion-dollar CHIPS Act is to create new fabrication facilities in the US and lessen dependency on Asian manufacturing.

Nvidia stands to gain from these investments even though it is not a direct manufacturer, especially through TSMC’s new $40 billion facility in Arizona. Industry insiders warn that increasing domestic chip manufacturing will take years and necessitate a high level of technical know-how.

Is Intel Potential to Join Nvidia as a Manufacturing Partner?

Unexpectedly, Intel has surfaced as a possible substitute for Nvidia’s production requirements. Although Nvidia and Intel have historically been bitter rivals, industry analysts believe that Nvidia may be able to diversify its supply chain by utilizing Intel’s sophisticated semiconductor fabrication capabilities following the establishment of Intel’s contract manufacturing division. Even though no official agreement has been made public, this kind of collaboration would revolutionize the semiconductor sector and highlight how crucial supply chain flexibility is.

The Prospects for Nvidia’s Chip Manufacturing

Nvidia is under increasing pressure to ensure dependable chip production in the face of global uncertainty, despite its dominance. Although Taiwan continues to be its main location for manufacturing, the company’s supply chain strategy may change as a result of its expansions in South Korea, Arizona, and possibly even Intel. Nvidia will probably have to strike a careful balance over the next ten years, utilizing Taiwan’s unparalleled experience while diversifying its manufacturing base to protect itself from geopolitical threats.

Nvidia’s capacity to guarantee a steady, robust chip supply will dictate its sustained dominance in the semiconductor sector as the AI revolution picks up speed. The business is putting itself in a position to not only withstand supply chain interruptions but also to completely reimagine computing’s future through strategic investments and international alliances.

6 Comments

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

非常感谢 路线。格外 有益。 鷹獵表演 欣赏你的照片, 我体会到, 世界很美。万分感谢 美好的心情。

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your article helped me a lot, is there any more related content? Thanks!